After saving for years to buy your home, it seems too careless to lose it because of disability, illness or retrenchment. If you don’t have a plan B for these instances, how will you be able to make your home loan repayments?

Disability and death are covered by Mortgage Level Term Asssurance (MLTA) or Mortgage Reducing Term Assurance (MRTA), but what about retrenchment?

If the word ‘retrenchment’ doesn’t send chills down your spine, the stats below would likely make you shudder.

From January to September 2015 alone, more than 20,000 employees lost their jobs in Malaysia, and the retrenchment trend is expected to continue in 2017. The truth is, job security is not what it used to be, and if you are unfortunate enough to be retrenched by your employer, getting another job immediately may not be as easy as well.

Hiring has also slowed significantly. Monster, a global online employment firm, said its year-over-year study of job postings on the Internet showed a 39% drop across all occupations and sectors in Malaysia.

Even jobs in the public sector were also harder to come by as the government froze hiring of civil servants except for critical positions last year.

What happens if you are the unfortunate one?

The possibility of losing our job is real, and it becomes more and more common in today’s economy. None of us likes to imagine misfortune befalling us, yet it can, and does happen.

So, ask yourself, how you would fare if you lose your job.

Do you have enough money set aside to pay for your mortgage for at least three months – if not more? A 525,000-property at 4.45% p.a. for 35 years will cost you RM2,327 a month. Three months of no income would have burnt a RM6,981 hole in your savings.

If you do not have this amount socked away, you can consider selling your home, but that may leave you and your family homeless. Furthermore, property is highly illiquid.

It’ll take a long time for you to finally sell your home and see your money because you will have to advertise or engage a real estate agent, conduct viewings with potential buyers, negotiate the price, wait for your buyer to settle his/her loan and other agreements, before the money would be paid to you.

By then, you may be looking at a three-month outstanding loan payment! By selling your home rashly, you will likely be selling it at a less than ideal price, and lose out on any potential profit from your property sale.

Whichever way you look at it, involuntary loss of job^ can wreak havoc in your finances, and you can end up losing your home.

What should your Plan B be?

To avoid the whole fiasco, you’ll need to prepare for the financial breathing room you need to get back on your feet.

Used to be unheard of, Malaysians now get additional insurance coverage to complement their purchase of a home from IJM Land.

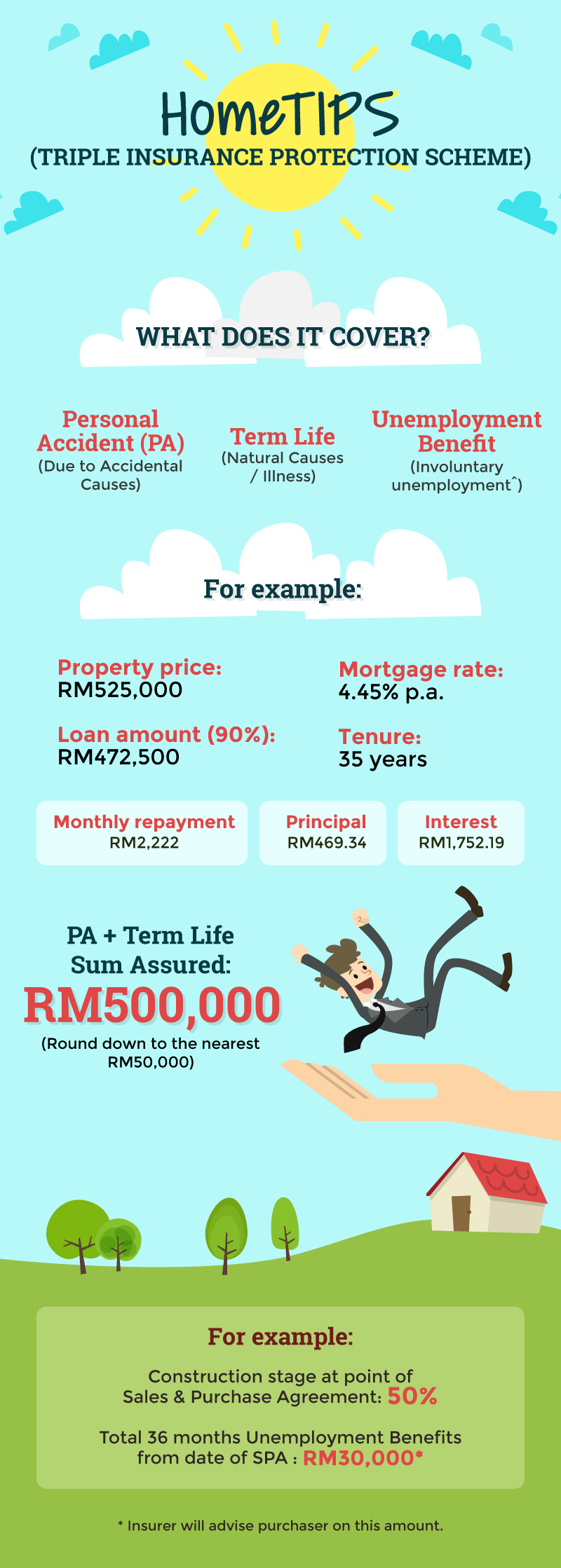

First of its kind, the HomeTIPS (Triple Insurance Protection Scheme) underwritten by Allianz, is available for IJM property buyers when they purchase any property from their participating projects.

The participating projects in the central region are Pantai Sentral Park in Bukit Kerinchi, Bandar Rimbayu Township near Kota Kemuning, Shah Alam 2 township in Puncak Alam and Seremban 2 Township in Seremban.

Other than the standard personal accident and term life insurance coverage to complement your MRTA or MLTA protection, HomeTIPS also covers your mortgage interest payment in the event of layoff.

Here’s how it works:

So, if you lose your job involuntarily, anytime within the 36 months from the date of the Sales & Purchase Agreement, the insurer will pay for the interest portion base on bank’s statement for the number of months you remain unemployed up to the maximum of RM30,000.

By having this coverage to help you with your mortgage, you can use your contingency fund for other important expenses such as insurance payments, car repayments, and other living expenses, while focusing your attention on getting a job.

Without the added pressure of paying for your mortgage, which is likely the biggest monthly expense you have to shoulder, you don’t have to take up the first job that you get, but instead get a job that you truly want.

Losing one’s job is a painful experience, not just financially, but it also affects our confidence in our capability. During this difficult time, the last thing you want to worry about is keeping your mortgage payment.

In bad economic times, it may take months, if not years, before you can land a job, and get back on your feet. Getting a mortgage insurance that also covers involuntary unemployment will help you spread out your finances, so you and your family will be protected.

The IJM LAND HomeTIPS mortgage insurance is a free coverage that comes with property buyers of any of their participating projects. Purchasing a home is a huge decision and does not just involve just your financial standing today. It must also come with forethoughts and long-term planning – and by having this coverage, you will be better prepared to remain committed to your home ownership in the years to come.

^ Applicable only for involuntary unemployment – Unemployment due to economic reasons afflicting the employer, and does not include unemployment due to disciplinary or non-performance of the individual.

No comments:

Post a Comment