You’ve figured out how much life insurance you need, how many years you will need it, how much you can afford and the type of policy that best fits your lifestyle.

But are you and your dependents really protected? What if you lose the ability to work and are unable to pay your premium next month? Will you still be protected? Or will your life insurance lapse, leaving you and your loved ones unprotected in times of need?

To ensure you are truly protected from all likely unfortunate events that may occur in the future, it is important to include the necessary add-ons, called “riders”.

Riders are special insurance policy provisions that offer additional benefits not found in the original contract, or make adjustments to it at an additional cost.

When you buy life insurance, available riders vary by insurance company and policies, as do the rules for how they work. The type of riders you should get depends on your age, health, number of financial dependents, and the type of policy.

Understanding how these riders work is necessary for designing your life insurance coverage to suit your needs and to make the most of your overall life insurance plan.

The waiver rider and the payor rider are two of the most common life insurance riders. Just what do they do and how do they work?

The waiver of premium rider

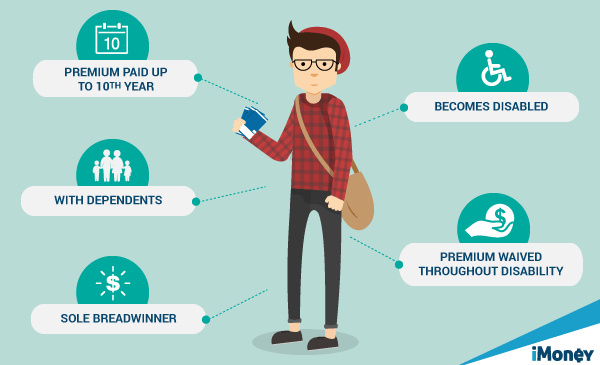

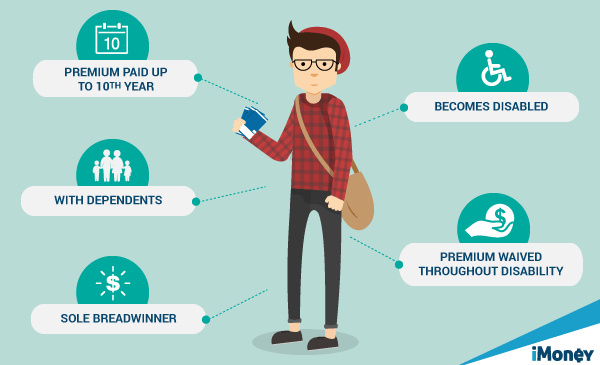

The waiver of premium rider exempts a disabled policyholder from the payment of premiums during the period of illness and/or disability, while keeping the policy in force. For the waiver of premium to apply, the insured’s disability must be permanent and total. A waiting period of three to six months normally applies before the benefits of the waiver of premium go into effect.

How it works:

For example, let’s assume that John Doe bought a life insurance policy from Company ABC, with the waiver of premium rider included. John paid his monthly instalments like clockwork for 10 years.

Unfortunately, he was met with an accident and rendered disabled, and can no longer work. However, with the waiver of premium rider, John’s life insurance did not lapse, and if he passes on later, his beneficiaries would still receive the proceeds of his life insurance policy.

Why do you need it?

A waiver of premium rider prevents a whole (or universal) life insurance policy from lapsing if the policyholder becomes disabled and loses his income-generating abilities.

In return, the rider protects the insured’s beneficiaries, who may require the eventual financial support from the policy to pay for housing, college or other living expenses when the insured dies.

However, to have a waiver of premium, some companies may place requirements such as being healthy or below a certain age on the policyholder. The drawback is most waiver of premium riders will increase your life insurance premium significantly.

Keep in mind that the waiver expires, often at age 60 or 65. Also, do read the fine print, for some waivers may exclude the payment of benefits for death by a specified cause such as a particularly hazardous occupation or hobby.

The payor rider

Similar to the waiver of premium rider, the payor rider safeguards the life insurance of a minor from lapsing in the event the policyholder is unable to pay the premium due to specified reasons. In most cases, a payor rider is linked to a juvenile insurance policy, where a parent or guardian is the policyholder who pays the premium, while the child is the insured.

The rider will apply if the policyholder dies or becomes disabled before the insured reaches an age that is stated in the policy (usually 21). Simply put, the child will still be protected by the insurance policy if something happens to the parent or the guardian.

How it works:

A father buys a life insurance policy on his 15-year-old daughter. The policy contains the optional payor benefit rider.

If the father becomes disabled, the insured’s (the daughter’s) premium will be waived until she turns 21.

Why do you need it?

The payor rider guarantees the possibility that the juvenile insurance policy will achieve what its policyholder wanted it to do, even if they are not around to see it happen.

For the policyholder, the payor rider provides protection in the form of a lump sum payment to the beneficiary, equal to the face amount of the rider. These riders usually cover the death of the policyholder, but they can also include cover for total and permanent disability too.

However, like the waiver rider, the payor rider does expose the insurance company to greater risk, so they must charge higher premiums for the rider.

No comments:

Post a Comment