Majority of Malaysians do not have adequate insurance coverage. This situation exists because not many of us are aware of the importance of financial protection, as we’ve been focusing solely on wealth accumulation through savings or investment gains.

What if we told you that not having adequate insurance coverage actually means you will risk missing out on your investment?

According to the “Protection gap or under-insurance gap in Malaysia” study, commissioned by Life Insurance Association of Malaysia (LIAM), both insurance and takaful cover only 56% of the Malaysian population – which is pretty low compared to other developed countries.

Malaysians generally do not take up adequate insurance protection simply because they lack the understanding of its advantages. Some are also under the misconception that insurance is something you get when you can afford it.

However, the reality is, the earlier you get your insurance, the higher the probability of being covered while you are still healthy.

However, the reality is, the earlier you get your insurance, the higher the probability of being covered while you are still healthy.

The bedrock of your financial plan

While investment is an important aspect of a financial portfolio, insurance coverage should be the foundation of any financial portfolio. It should be the first step.

A holistic financial plan should include protection planning by incorporating health, disability and life.

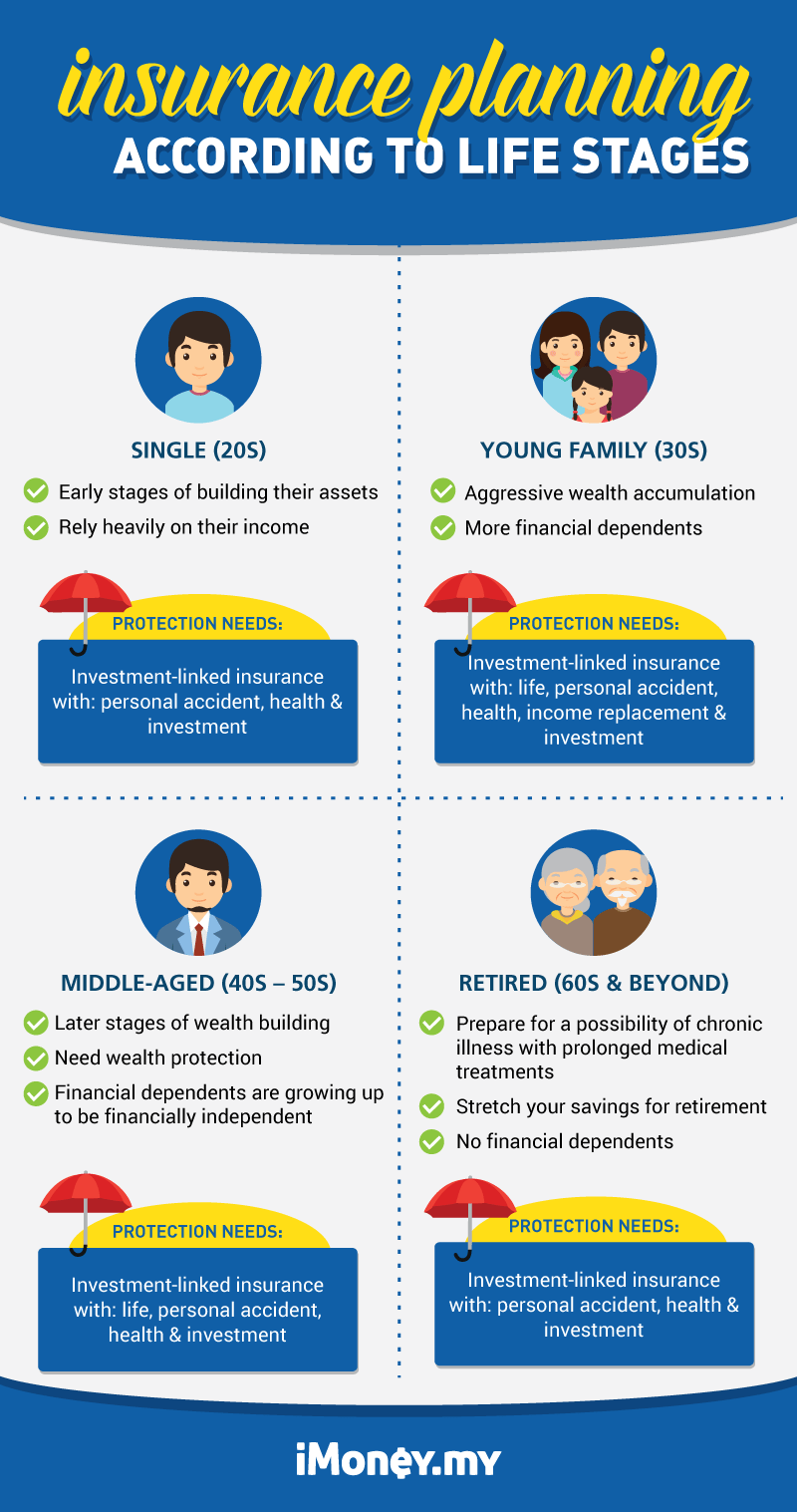

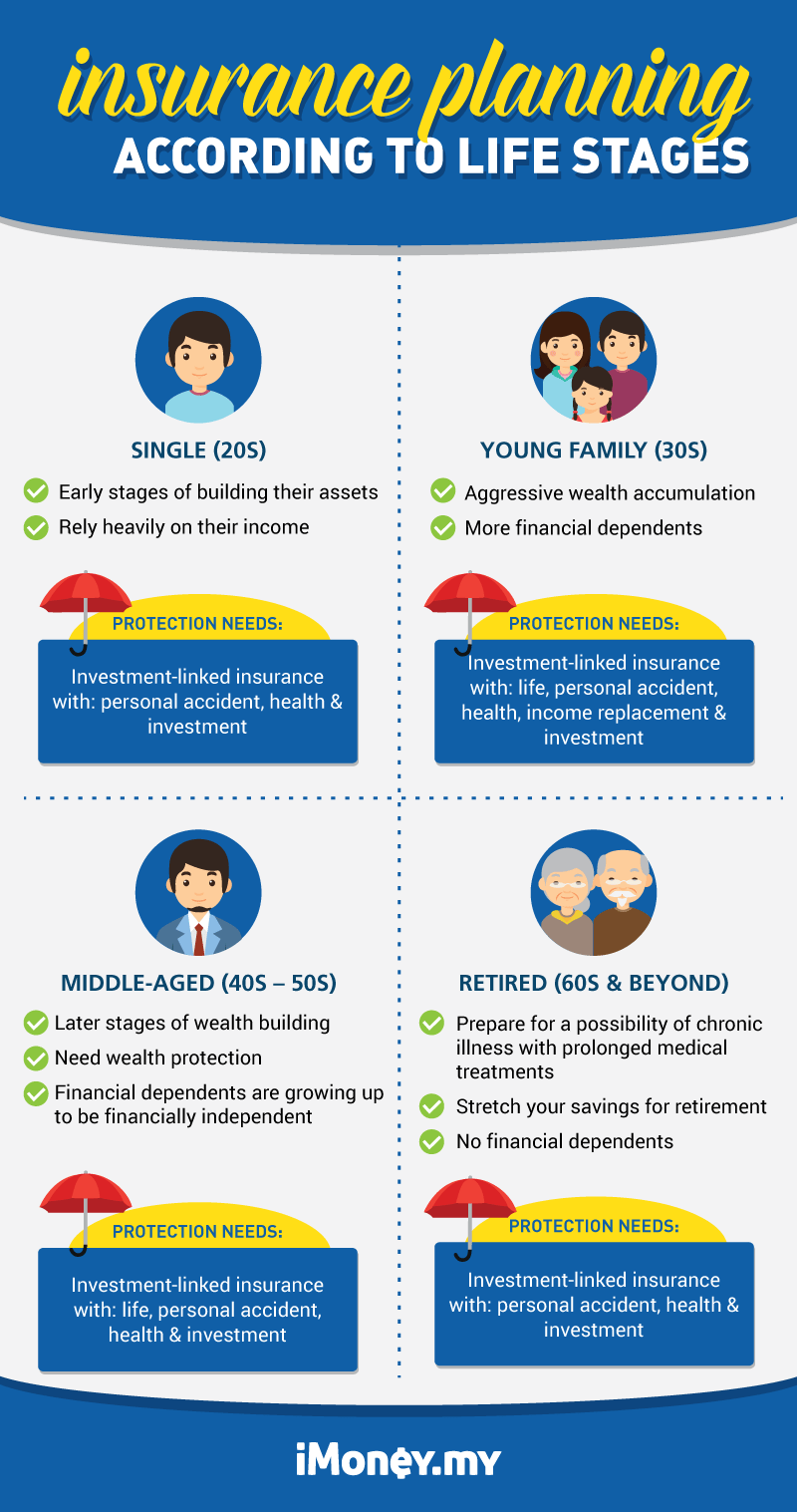

The level of protection can be adjusted according to life stages and individual situations and circumstances. Here’s a rough guide of protection needs according to life stages:

The financial damage caused by the lack of insurance coverage can be devastating to a family. One way to close the protection gap in your financial plan is with an investment-linked policy (ILP). An ILP offers life protection, personal accident, medical insurance, and other riders such as critical illnesses and payor waiver.

The unique feature of an ILP is that a certain portion of your premium will be invested in a specific fund of your choice, while the rest will be used to pay for the coverage. Though the investment part of an ILP is rarely trumpeted, its benefits are far-reaching in the long-term. Having certain percentage of your premium invested will give you a chance of higher cash value at maturity, it will also tide you over when finances are tough and you are unable to fulfil your premium obligation (premium holiday).

For financial goals to realise, one must always be prepared for any eventualities – and that means preparing for the possibilities of:

- Loss of income-earning ability due to:

- Pre-mature death

- Disability

- Unemployment

- Retirement

- Extra expenses associated to:

- Illness

- Accidental injuries

- Medical treatments

Of course, different individuals or households would have different protection needs, but the fact is, they will all need protection.

- Pre-mature death

- Disability

- Unemployment

- Retirement

- Illness

- Accidental injuries

- Medical treatments

No comments:

Post a Comment