No one sets out to be bankrupt when they take on a loan. Neither will they default on their payments without a good reason. There are many reasons for falling into debt but so many don’t realise the consequences of it. Being declared a bankrupt is not a small matter, and neither is it easy nor simple to remedy.

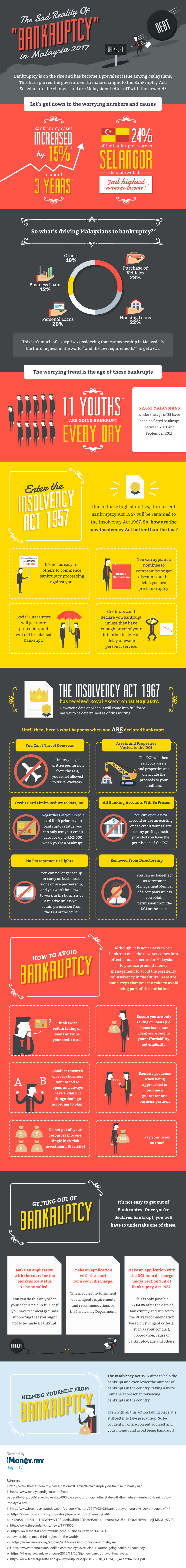

Yet the sad fact remains that the number of bankrupts have been on the rise in recent years. Actions must be taken, not just prudence by borrowers but also new policies and laws must be drawn to control the number of bankrupts in the country.

This has prompted a new bill to be passed to help deal with the high number of bankrupts in the country. Minister in the Prime Minister’s Department Datuk Seri Azalina Othman Said had introduced an amendment to the Bankruptcy Bill 1967 in hopes to reduce the bankruptcy rates in Malaysia.

However, the most important aspect of preventing bankruptcy truly lies in each individual’s financial prudence when it comes to borrowing and repayments. It all boils down to understanding the difference between eligibility and affordability.

No comments:

Post a Comment