| |||||||||||||||||||||||||||||||||||||||||||||

Looking for ways to cut down on your household expenses? We show you how you can do it by using the right credit card.

Out of the six financial concerns we asked Malaysians in a recent survey, the high cost of living emerged as the top concern weighing on their minds.

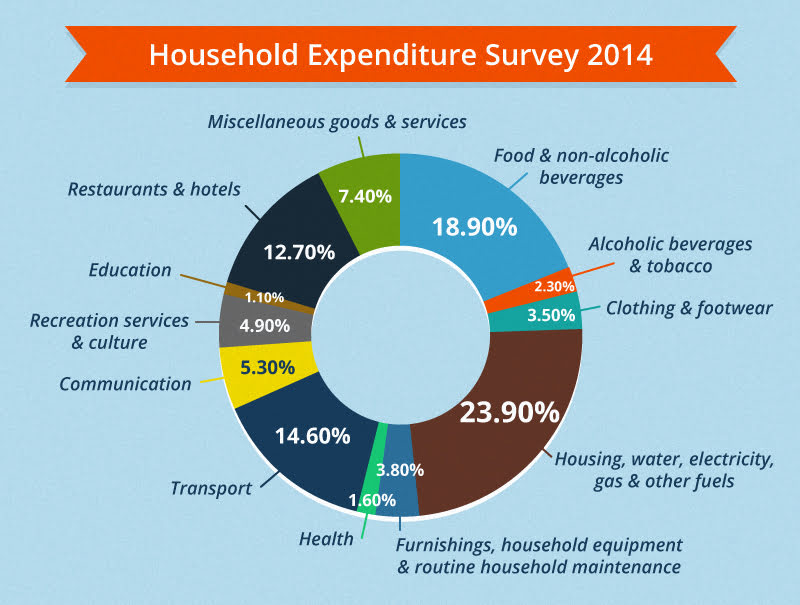

Housing, petrol, groceries and dining out are the biggest outgoings for families in Malaysia based on the figures released by the Department of Statistics in 2014. In 2014, an average household spent a total of RM3,578 a month, an increase of 9.8% per annum at the nominal value since 2009. On the other hand, the median monthly household income by strata in urban locations only grew at 9.8% per annum between 2012 and 2014.

This means consumers are being pressured on both sides, making it increasingly difficult to thrive financially.

Based on the chart above, the average Malaysian spends about RM2,508.18 on these necessities, which include petrol, groceries and eating out.

While food, eating out and petrol may be out of our control, there are ways we can manage our expenses and cut spending without sacrificing quality of life.

Don’t worry, we are not asking you to start penny pinching and butchering your personal budget (though that may help in most cases). By using existing products to optimise your finances, you can cut your household expenditure easily.

One of the easiest tools to use is a credit card. However, the key is to use the right credit card that fits your spending habit and lifestyle.

1) High cashback credit card

Some of us think that a cashback card would only make an impact when you spend on big-ticket item. However, small recurring expenses can also add up to a large amount at the end of the month.

The best way to maximise your cashback is to identify your biggest monthly spending, and then find a credit card that offers high rebates for those spending categories. Some of the highest recurring expenses that most Malaysians have are groceries, dining out and fuel.

There are many cashback credit cards in the market, but one of the cards that offer the highest cashback is the HSBC Amanah MPower Platinum Credit Card-i. For example, if you spend more than RM2,000 on the card in a month, you get to earn up to 8% cashback on groceries and petrol.

Here’s how much you have to spend on groceries and petrol to get the maximum RM50 monthly cashback:

Total cashback is RM74.20 (RM72 + RM2.20), but monthly cashback is capped at RM50 a month for petrol and groceries. So, the total cashback is RM52.20. If you are able to save about RM50 a month on these expenses, you will be saving up to RM600 in a year!

To put things into perspective, if you put the same RM600 in an investment product that gives you 5% per annum for the next five years, you will have RM4,246.92 balance waiting for you!

2) Good rewards credit card

If cashback is a little too complex for you to keep track of, you can stick to good ol’ rewards credit cards. Though you are not rewarded with cold, hard cash, you get to slowly accumulate your points and redeem something worthwhile.

How do rewards credit cards work? For every ringgit you spend, you will be rewarded with credit card points. The points can then be used to redeem products or air miles. The best rewards credit cards are not just those that give you high points for every ringgit spent, but also those that give you high value for the points accumulated.

Here’s example of how you can compare points redemption value:

Compared to Maybank 2 Cards, HSBC Visa Platinum allows you to redeem air miles with less reward points. To redeem 1,000 Cathay Pacific Asia Miles, you just need to spend RM1,400 locally, or RM875 overseas. By spending RM1,400 locally on your card every month, you will have enough points to redeem 12,000 Asia Miles by the end of 12 months.

Of course, you can redeem more than air miles with your reward points. With 84,000 points collected in a year, you can redeem an Elba Microcomputer Rice Cooker 1L with 73,000 points. That’s RM200 savings!

3) Solid balance transfer programme

With the high cost of living, it really takes some financial ninja moves to stay out of debt. However, if you have incurred some credit card debts, it is not the end of the world.

The best action to take is the swiftest action. Don’t neglect your problem, but find a solution before your debt balloons into something unmanageable. One of the easiest ways for you to tackle your credit card debts is to use a good balance transfer programme.

What makes a credit card balance transfer programme good? It should have a low to 0% interest rate, long repayment tenure and 0% processing or management fee.

From now till June 30, 2017, new HSBC & HSBC Amanah customers can transfer their credit card debts over at 0% interest rate and 0% management fee for 12 months. This is how much you can save:

With the right balance transfer, you get to pay off your debt quickly and at zero interest! Never sweep your debts under the rug, but tackle it as soon as possible. In this case, time really equals money because the longer you wait, the bigger your debts will get due to the compounding interest.

The point of this article is really to point out the importance of having the right credit card for your needs. There is no single credit card that is the best for everyone. It all boils down to your lifestyle and spending habits – and sometimes, even location!

For example, the HSBC Visa Platinum credit cards offer up to 8x reward points for retail spending in Mid Valley Magamall and The Gardens Mall. If you do not stay nearby or only visit these malls once a year, this perk is pretty much useless.

Even a credit card that is perfect for your lifestyle can be rendered useless if you have terrible money management habits. Missing payments or late payments means incurring interest, and that will ultimately dwarf whatever gains from the cashback and reward points you have accumulated.

Don’t be a slave to your credit cards. Instead, learn how to use them as a tool to make your money work harder for you.

| |||||||||||||||||||||||||||||||||||||||||||||

Tuesday, August 01, 2017

The Easiest Way To Cut Your Biggest Household Expenses

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment