If history is any guide, under Republican US President Donald Trump, Asian stock markets, especially Malaysia’s – which is up 4.8% this year so far in US dollar terms – should continue to perform strongly this year… and in 2019.

But history may not be much of a guide. On his first day in office, Trump turned the global trade system on its head by signing an executive order to pull the US out of the Trans-Pacific Partnership (TPP).

This is part of Trump’s “America first” policy – and may hand the mantle of main supporter of globalisation to China.

Meanwhile, President Trump’s next tweet storm – or the one after that – could hit Asian (or any other) markets.

The US election cycle and Asia’s stock markets

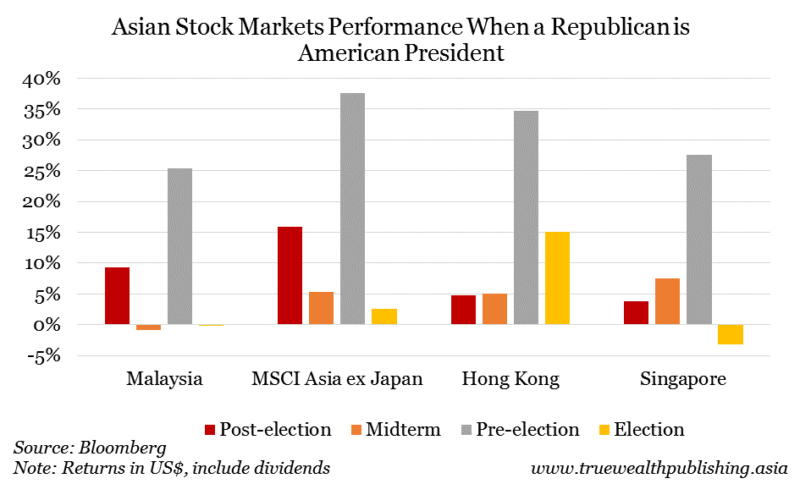

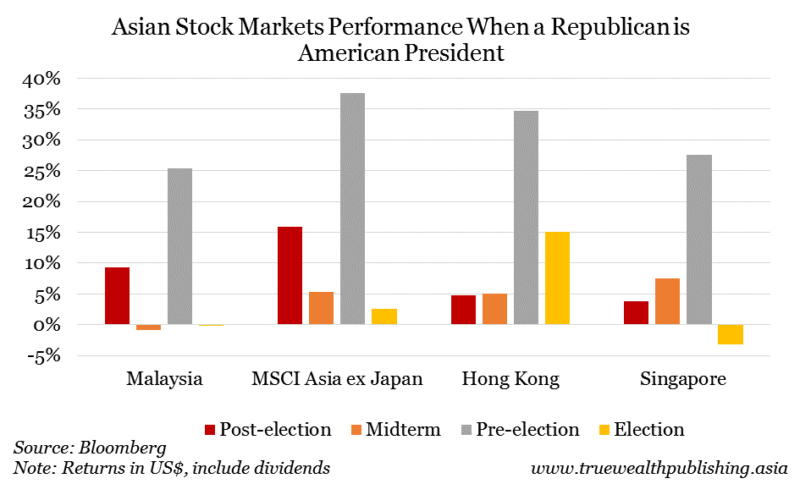

In the past, when a candidate from the Republican party of the US (such as Trump) became the country’s president, Asia’s markets had performed well overall during the first year (referred to as post-election year in this article) of the new president’s term. Since 1981 there had been five Republican presidents in the US. During their first year, the KLCI has gained 9% on average.

But the real fireworks really begun during the third year (which will be 2019 in the current US presidential cycle, also referred to pre-election year) of a Republican president’s four-year term. During the third year, the MSCI Asia ex Japan Index saw average returns of nearly 38%, while Malaysia’s stock market has risen an average of 25%.

Except for Hong Kong, election year (which was 2016 in the most recent election cycle) has been generally weak for Asia’s markets, with the MSCI Asia ex Japan rising just 2.6%, while Malaysia dropped by 4%.

No comments:

Post a Comment