This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative

Blue chip stocks tend to earn a reputation for staying stable and weathering downturns by operating profitably even amid challenging economic conditions.

What are blue chip stocks?

In poker, the term “blue chip” signifies the chip with the highest value. This term was then adapted into stock market terminology, where blue chips are basically the stocks from what can be considered a blue chip company.

In general, blue chip companies are nationally-recognised entities that sell high quality and widely-accepted products and services. For a stock to be considered a blue chip, it should be the market leader or among the top performers in its sector. Companies in these positions would be able to operate regardless of market conditions, thus earning the status of “blue chip”.

In the United States of America, many blue chip stocks are household names, such as American Express, Coca Cola and Disney. Similarly, Malaysia’s blue chip stocks are from established companies like Maxis, CIMB and Genting to name a few.

Typically, a blue chip stock will make up the component of a market index. For example, if you were to look at Kuala Lumpur Composite Index (KLCI) stocks, you’d find companies like CIMB, Maxis and other major companies.

Why invest in blue chip stocks?

To the uninitiated or inexperienced investor, market volatility and lack of knowledge can spell disaster, especially when they trade purely on rumours and false hopes.

While there is nothing really wrong about investing in smaller growth companies in the hopes of eventually earning large capital gains, there is a huge risk involved in it. The prices of these companies can be affected by many elements beyond just their own performance such as local and even external market conditions.

On the other hand, blue chips tend to be stable and not significantly influenced by these market conditions even during recessions, and are a good option for capital preservation. They’re a great way to balance out the volatility in your investment portfolio.

Since blue chip companies are also past the growth stage, they’re generally going to be dividend paying stocks. For investors looking for lower risk investments that provide passive income, blue chips are considered the “safest” stocks.

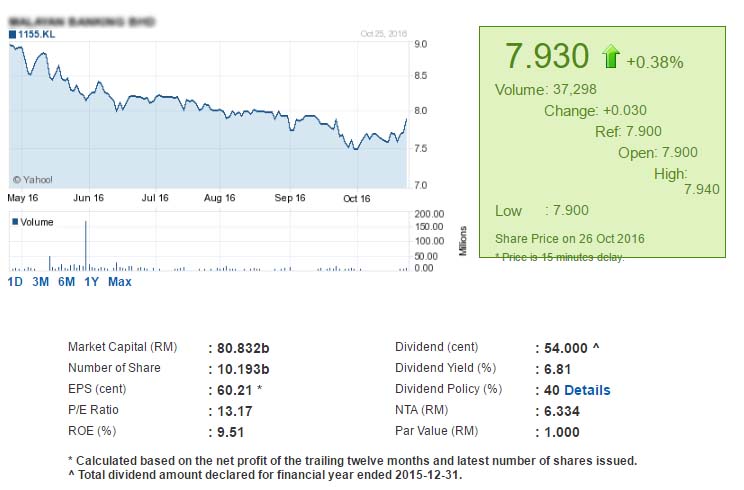

However, blue chip lots are usually more expensive. For example, the price of one share from the example below cost RM7.930.

How to get started?

You can directly purchase individual shares through a brokerage. You may want to consider a “value investing strategy” to look out for stocks to purchase when they are under-priced.

If you don’t have the capital to invest in multiple blue chips, you may also invest in a basket of blue chip stocks through unit trust funds or an Exchange-Traded Fund(ETF). Some of these funds are identified by the use of the term “blue chip” in the fund name.

This option provides diversification across a number of economic sectors to help mitigate company and market risks.

Are blue chips for you?

Your own investment goals and objectives will determine whether blue chip companies are the right match for you. Not all investors are created equally or want the same results . While some prefer less risk, others with a higher risk tolerance or larger net worth may prefer higher risk investment vehicles that can potentially generate higher yields in shorter periods.

Some will prefer blue chip stocks as a safer source of fixed passive income with the benefit of some capital appreciation in the long term. Others might prefer blue chips for diversification purposes or to compensate for the risks they take with their higher growth stocks.

Ultimately, it all comes down to understanding how blue chips work and fitting them into your own investment strategy. Making an informed investment decision requires you to understand your own finances and risk profile first, then understanding which tools you have on hand to achieve your investment goals. Blue chip stocks are just one of the many legitimate, legal and regulated tools available to help you achieve those goals.

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.

Source: imoney

Or you can always save and invest in SSPN-i Plus where it's 100% back by Malaysian Government and past record of return was averaging 4%! Click below link to know more.

CLICK HERE

CLICK HERE

No comments:

Post a Comment