Find out in

the Price Guide to Chinese Coins,

Panda Pricepedia.

the Price Guide to Chinese Coins,

Panda Pricepedia.

Gold Pandas

Silver Pandas

Platinum Pandas

Home

Home

Avoid Mistakes!

Buy the Book Before You Buy the Coins

Buy antiques in times of peace and prosperity, and gold in times of turmoil. Chinese saying

_Panda Book••• •••

••Price Guide

_•Coins for Sale•• ••• •••

Counterfeits Report

Why Buy a Panda?

While chatting with a coin dealer the other day, I heard a story about a customer who walked in with a 4 coin set of the old style (pre-1933) U.S. gold coins to sell. These are collectible coins that some people consider safer than gold bullion against government confiscation. The customer told how he had paid $14,000 for his set five years ago. The coin dealer sadly shook his head and said, “I could only offer him $10,000 for them. That’s all they’re worth today.”Then he looked at me and asked, “How much would his $14,000 be worth today if he bought Pandas?” So, let’s suppose that 5 years ago Mr. Customer bought $14,000 of either gold bullion or gold Pandas and compare the results. Since January 3, 2006 gold bullion has risen from $530/oz. to $1,350/oz., a rate of 21% per year. At that rate $14,000 would have grown into a tidy $34,560. Bull markets sure can be fun!But how things would have turned out with gold Pandas? Assuming that five years ago Mr. Customer walked into a coin store and bought 14 grand of the latest 2005 and 2006 Pandas, he would now be looking at an investment worth $42,000 — a gain of 25% per year.

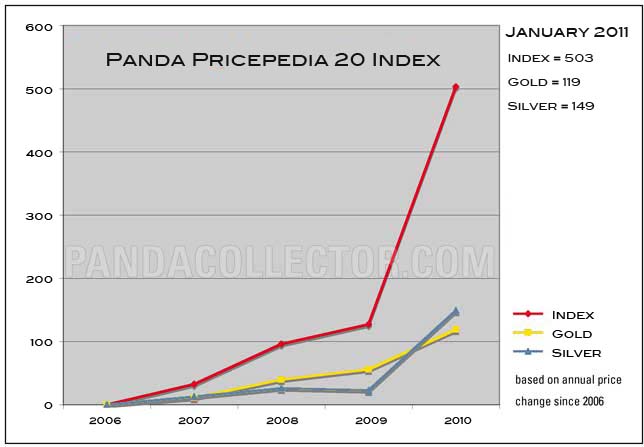

Why the greater gain for gold Pandas over plain gold? There are several reasons:Only 55,000 1 oz. gold Pandas were struck for 2005. Some of those were used in jewelry. Others were traded as bullion and damaged in handling. So the supply of collector grade gold Pandas is now quite limited.The collector market for Panda coins is expanding and shows no signs of slowing down. This is true both in China and the rest of the world. The Chinese government promotes ownership of precious metals to its people and the top Chinese gold and silver coins are Pandas.Information about Pandas has become more available through the internet and the publication of a book devoted to them. These resources have increased public knowledge and interest in Panda coins.Maybe you are wondering, what about silver? How did it do? Back at the beginning of 2006 you could have walked into a coin store and bought silver bullion coins for around $9.30 apiece. $14,000 would have allowed you to cart away 1,510 oz. of silver that are now worth $43,800. That’s up 26%.Because of their premium over bullion , if a buyer chose to buy silver Pandas he or she would have only gotten 1,175 silver Pandas for $14,000 in 2006. But look what happened; today the Buy price on 2005 silver pandas is $50. 1,270 Pandas are worth more than $58,750 for a gain of 33% per year!Here’s one more comparison to consider. The Panda Pricepedia 20 Index, made up of coins with populations under 2,000, has risen 38% per year. That translates to $70,000 from the original $14,000.That takes care of the last five years but what about the next five? Can the trend continue? It seems to me that unless China becomes a substantially smaller and poorer nation, the mix of limited supplies of Pandas (particularly past years) and more collectors and investors could easily means higher prices. Look for the greatest gains to go to scarce and undervalued issues. Happy collecting.

2 comments:

Great post, at this time Gold has been advancing for over 10 years now, from a low of $252 per ounce in 1999 to where it sits today at $1,755, which is a gain of over 595%. With gold at unprecedented levels (previous bull market high was $850/oz) is it any wonder why someone would question starting to acquire gold?

us gold coins

definitely will shoot up rapidly this year. May all prosper :)

Post a Comment