No matter which way you cut it, you can never have too much protection to safeguard your finances in old age. You never know when you will need that money. When it comes to your long-term care, the idiom ‘better safe than sorry’ stays true.

Hence, when the Employees Provident Fund launched the Akaun Emas in November 2016, it was welcomed news indeed and another step in the right direction to address Malaysia’s ageing needs. The Akaun Emas, effective this January, aims to help EPF members save a second source of funds to serve their needs when they retire.

While it is a good initiative, will it last till the time we need long-term care in our old age? With the average life expectancy of Malaysians having gone up to 75 years of age, Malaysia is 13 years away from being classified as an ‘ageing society’ – with the senior population reaching 15% by 2030.

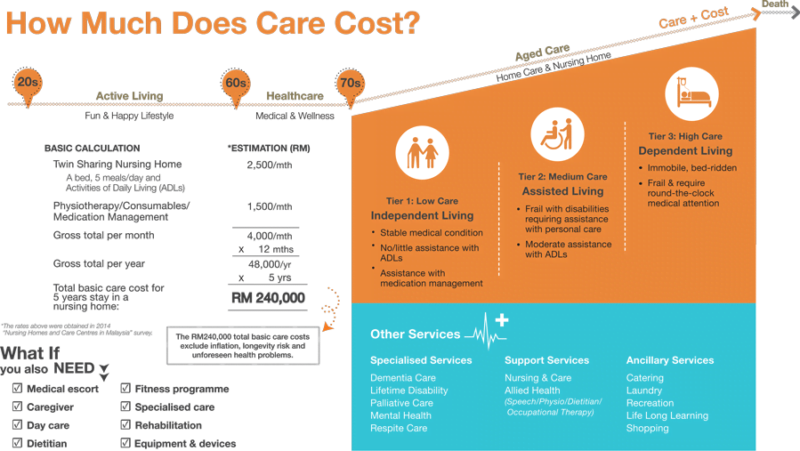

So what does this mean for our long-term care needs in our financial planning and retirement? First let’s look at the anticipated cost of care.

Source from www.managedcare.com.my

Source from www.managedcare.com.my

Source from www.managedcare.com.my

No comments:

Post a Comment