| |||||||||||||||||||

Can you imagine a day go by with no access to the Internet? Sounds like a nightmare to many of us.

We are so used to having technology enriching our lives in different ways, we can’t imagine living without it. This goes beyond checking up on your Facebook friends, or sending WhatsApp messages to your colleagues.

The Internet does not just make our lives easier, it can help us save some cash too. With the cost of living rising at an alarming rate, seeking value and bargains is as important as ever. With the Internet access, it becomes so much easier to find deals and save money.

Here are 6 ways that you can save money and time (because time equals money) using the Internet:

| |||||||||||||||||||

| Loan amount | ||

| Loan tenure | ||

| Interest rate | ||

| Monthly instalment | ||

| Total interest |

In this example, the lower interest rate save you RM1,860 over the five years loan tenure.

This just proves that a little research goes a long way when you are shopping for financial products, be it personal loan, credit card or insurance plan. With the Internet, product research has just become easier and more convenient.

3. Paying bills online or automating payments

Late payment is the worst – not just because it will cost you money, it also has long-term repercussion to your financial health. Paying off your credit card or financing late could badly affect your credit report. Every time you miss a payment or be late on a payment, it will be reflected on your Central Credit Reference Information System (CCRIS) report.

Having a bad record on your CCRIS report means you may not be able to obtain more credit in the future. You will also have to pay for your tardiness. Late penalty could be as much as RM10, while for credit card it means having to pay higher interest rate in the future.

Though we try to be mindful of the due dates of our bills, sometimes life happens. This is why being organised about your bill payments must take precedent.

You can do so by setting up automated payment online using whatever bank platforms your account is on. Each transaction would cost RM2 in service fee. Even if you are not keen to set up standing instruction, you can still make online payment anywhere and anytime.

4. Swapping and selling

Impulse purchase – we’ve all done it before. But we don’t have to beat ourselves up every time it happens because we can still cut our losses by swapping or selling items we don’t need for things that we do need or for cash.

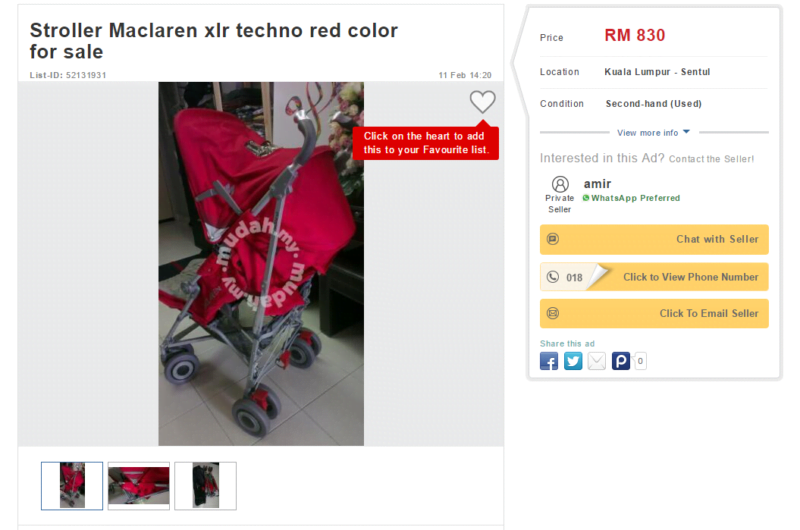

The Internet has made all these possible without too much hassle. There are Facebook groups and websites dedicated for people selling preloved items. For example, you bought an expensive stroller for your child and now your child has outgrown it. You can sell the stroller at a much cheaper price on the Internet and recover some of the money for other things that you need.

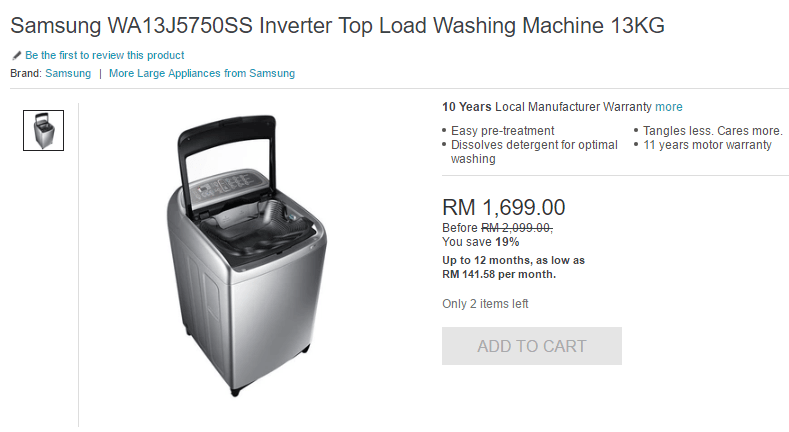

Here’s a comparison of a brand new stroller versus a preloved stroller. If you are looking to buy, you can always consider buying preloved for certain items to save some cash.

Brand new stroller sold on Lazada.

The same stroller sold as preloved on Mudah.my.

5. Offering your products and services

With today’s financial demands, it’s getting harder to get by with just a single income, which is why so many Malaysians are turning to ride-sharing for side income.

However, if driving is not your cup of tea, you can still earn some money through other side gigs like freelance writing, designing or even selling your crafts. With more websites available to make it easier for you to market yourself and your services, making extra cash is becoming increasingly easy.

Some of the websites you can consider are:

- Upwork

- com

- Etsy

If you rather not spend any money listing your ad or paying commission, you can offer your services or products on Facebook. However, this may take some time to take-off compared to these professional platforms, depending on your network.

6. On-demand streaming services

How much are you spending on your broadband subscription and on-screen entertainment? If the answer is close to RM400, you can probably trim your expenses further. You can cut that spending significantly by opting for on-demand streaming services, such as iflix or Netflix.

For example, if you signed up to a satellite TV subscription, you will be spending about RM150 a month plus installation fee of RM100. With on-demand streaming services, you don’t need to pay installation fee and the fee ranges from RM10 to RM51 a month, with no installation fee.

However, for these on-demand streaming services, you will need a high-bandwidth broadband connection. For example, if you have more than eight devices used at home and streaming movies and TV shows is one of the top online activities, the recommended home broadband would be Maxis ONE Home 50, TM UniFi Advance Plus 50 or any of the TIME home fibre broadband packages.

By spending a little more on your broadband, and significantly less on your TV subscription, you will still save some cost at the end of every month.

There are many ways we can leverage on the Internet to help us manage our finances a little better. From budgeting apps on our smartphones to organising group buys for cheaper prices – the Internet has made it all possible for us to trim our expenses and also increase our income.

No comments:

Post a Comment