How do you measure financial success? Most people would measure it by looking at a person’s bank account balance, or the number of assets owned. No matter how you may define it, financial success is really just about making wise decisions with the money that we have.

Consistently making wise money decisions would likely lead to a sizeable bank account balance or a healthy number of assets owned. It takes determination and hard work to accumulate and preserve wealth over generations.

Sustainable wealth does not happen by accident — or overnight. It takes serious willpower and long-term vision.

If you want to get on that track, do what the one’s who’ve made it do. Here are 5 things financially successful people do:

Priority #1. Be disciplined with their money habits

Sure, being frugal and having an emergency fund are all good money habits, but let’s face fact: Alone, they are hardly going to make us rich.

With inflation and the cost of living going up, and our purchasing power going the opposite direction, not spending RM17 on a frappucino isn’t going to help us cope financially. Being disciplined with their savings helps bring the financially successful people a step further.

Consistent money saving takes willpower and discipline, but for it to make a significant positive impact on our finances, we have to choose how we save our money wisely. If you put RM300 in your savings account every month, you will lose the value of your money over time due to inflation.

Choosing a savings product that will allow you to put away a set amount of money consistently for a long period of time, while growing your savings – that is the key of successful saving habit.

The i-Great Mega by Great Eastern Takaful allows you to consistently put away an affordable amount every month over a long period. It also allows the flexibility that you need to ensure your money is doing its best to give you the returns that you need in the future, while also protecting your loved ones (more on this in the next point).

The plan you choose should balance both discipline and flexibility that are crucial for those who are looking to plan for more, for their family.

Priority #2. Get a Takaful plan to protect their family

You’ve worked hard to provide for your family. There are great plans ahead of the family – from paying off the mortgage to sending your children to top-notch universities.

However, a single devastating event can trigger the domino effect – it can be in the form of death, serious illness, accident or even a job loss.

If you are the breadwinner of your family, your ability to earn an income is your family’s greatest asset. Anything that can jeopardise that would change everything.

This is why getting adequate protection plan such as takaful is key to ensure your loved ones can maintain their lifestyle and pay the bills if something happens to you.

Takaful, acting as a backup plan, doesn’t just give your dependents the financial Plan B when you are no longer around. It protects your family’s hopes and dreams even in your absence.

The longer the takaful coverage is, the better off you and your family will be. The i-Great Mega lets you choose between a 10-year payment term and a 20-year payment term for the coverage of 30 years. This means, if you participate in the plan at 35 years old, you will be paying your contribution for either 10 or 20 years, but be protected up to age 65.

Priority #3. Look at the big picture and plan long-term

People who take a lackadaisical attitude towards their retirement planning, often jokingly says, who knows how long we will live. But, the question is, what if we do live long? For the financially savvy, they count on living long and as such, they always work towards ensuring their retirement fund will outlive them.

Retirees often live in fear that they will be destitute in their retirement – and this can very well be a reality even if one has a retirement saving.

The Employees Provident Fund (EPF), a mandatory retirement scheme found only 22% of the 6.7 million active contributors aged 54 years have sufficient savings of RM196,800 or more to sustain themselves during retirement. This means 78% of them have less than RM800 a month in their retirement.

This proves that we need to do more to plan for our retirement. The general rule of thumb is to save an additional 10% of our income, on top of what we are saving in our EPF account. It’s important to ensure we are investing this additional savings to protect our money from being eroded by inflation.

To be able to do that, the investment rate of returns must be higher than the rate of inflation, and cover your investment costs.

Priority #4. Stay motivated to work towards their financial goals

It has been ingrained in our brains that saving and investing for the long-term is the way to go. To put aside money now for our golden years is extremely important, but sometimes life gets in the way.

It could be a much-deserved family vacation, or maybe sending your child to college – these decisions can delay your ultimate financial goals. So, what can you do to juggle your long-term goals with other short- to medium-term goals?

The key to succeed lies in looking for rewards that will motivate you to stay on course, and also nudge you closer to your goals.

With i-Great Mega, all takaful participants pool their money together in a Tabarru’ Fund (voluntary contribution) which will be used to pay the claims. In this plan, any underwriting surplus, after a suitable amount is held back for contingency purposes, will be shared among the participants and the Takaful Operator in the ratio of 50:50. Furthermore, contributions towards your takaful plan will be qualified for tax relief of up to RM6,000 a year.

This means the surplus will be added into your Participant’s Unit Account (PUA)* to grow together with the money that you contributed monthly. Together with their loyalty benefit, you can see a percentage of returns reinvested into the fund of your choice.

* Assuming that all contributions are paid up to date and no partial surrender was performed.

Source: Great Eastern Takaful

Source: Great Eastern Takaful

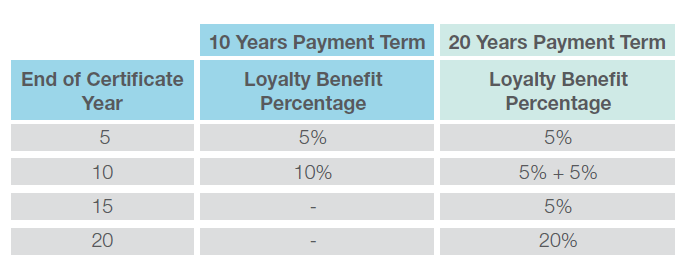

A certificate holder of the i-Great Mega will receive loyalty benefit, which is a percentage of the contribution paid at the end of every fifth certificate year.

For example, if you take up the 20 Pay Plan with monthly contribution of RM300, here’s how much you will be rewarded over 20 years in loyalty benefit:

Priority #5. Always know how hard their money is working for them

As with any investment, there is no guaranteed returns. We can’t expect to put a sum of money in an investment, leave the money to its own devices and expect a pot of gold at the end of the rainbow.

Successful investment takes hard work – from understanding your investment, to monitoring and making the right decisions at the right time.

Financially successful people understand this and usually take active interest in where their money is, and how well it is doing. Even if the money is in an investment-linked plan.

The i-Great Mega plan allows you to choose from a range of professionally managed funds and decide on a combination that works best for you from these three Shariah-compliant funds:

The Dana i-Makmur is categorised as low-risk fund with pure Islamic fixed income investments, which has typically low price volatility.

from 13 December 2010 - 31 October 2016 | |||||||

|---|---|---|---|---|---|---|---|

| Dana i-Makmur | |||||||

| Benchmark - 12 month Islamic Deposit | |||||||

On the other hand, the Dana i-Majmuk is in the moderate risk category as this fund offers a combination of Shariah-compliant fixed income and equity investments, which may be volatile in the short term but more stable and rewarding in the long term.

from 10 December 2010 - 31 October 2016 | |||||||

|---|---|---|---|---|---|---|---|

| Dana i-Mekar | |||||||

| Benchmark -FTSE M'sia Emas Shariah (FBMS) | |||||||

Lastly, for those with bigger risk appetite, the Dana i-Mekar is categorised as high-risk as this fund offers pure Shariah-compliant equity investment plus some foreign Shariah-compliant equity exposure, which can be volatile in nature.

from 10 December 2010 - 31 October 2016 | |||||||

|---|---|---|---|---|---|---|---|

| Dana i-Mekar | |||||||

| Benchmark -FTSE M'sia Emas Shariah (FBMS) | |||||||

Regardless of where you park your money, it is important that you know and understand the fund you are investing in. This will make it easier for you to make investment decision later on.

If you’d like to find more success with your money, procrastination has no place in financial success.

Though financial visions and priorities differ for everyone, the financial priorities listed above should be able to help propel your finances forward. Finances are integral to our life, hence we need to make finances a priority.

Visit our website to know more about i-Great Mega and make an appointment with a Takaful Advisor to receive consultation so that you can get the right plan.

* Participant’s Unit Account (PUA) refers to the account into which the units are allocated,

depending on the amount of contributions paid.

depending on the amount of contributions paid.

![20161202-[client-i-Great-Mega]-Mini-graphic](https://www.imoney.my/articles/wp-content/uploads/2016/12/20161202-client-i-Great-Mega-Mini-graphic1.jpg)

No comments:

Post a Comment