Blue chip stocks tend to earn a reputation for staying stable and weathering downturns by operating profitably even amid challenging economic conditions.

What are blue chip stocks?

In poker, the term “blue chip” signifies the chip with the highest value. This term was then adapted into stock market terminology, where blue chips are basically the stocks from what can be considered a blue chip company.

In general, blue chip companies are nationally-recognised entities that sell high quality and widely-accepted products and services. For a stock to be considered a blue chip, it should be the market leader or among the top performers in its sector. Companies in these positions would be able to operate regardless of market conditions, thus earning the status of “blue chip”.

In the United States of America, many blue chip stocks are household names, such as American Express, Coca Cola and Disney. Similarly, Malaysia’s blue chip stocks are from established companies like Maxis, CIMB and Genting to name a few.

Typically, a blue chip stock will make up the component of a market index. For example, if you were to look at Kuala Lumpur Composite Index (KLCI) stocks, you’d find companies like CIMB, Maxis and other major companies.

Why invest in blue chip stocks?

To the uninitiated or inexperienced investor, market volatility and lack of knowledge can spell disaster, especially when they trade purely on rumours and false hopes.

While there is nothing really wrong about investing in smaller growth companies in the hopes of eventually earning large capital gains, there is a huge risk involved in it. The prices of these companies can be affected by many elements beyond just their own performance such as local and even external market conditions.

On the other hand, blue chips tend to be stable and not significantly influenced by these market conditions even during recessions, and are a good option for capital preservation. They’re a great way to balance out the volatility in your investment portfolio.

Since blue chip companies are also past the growth stage, they’re generally going to be dividend paying stocks. For investors looking for lower risk investments that provide passive income, blue chips are considered the “safest” stocks.

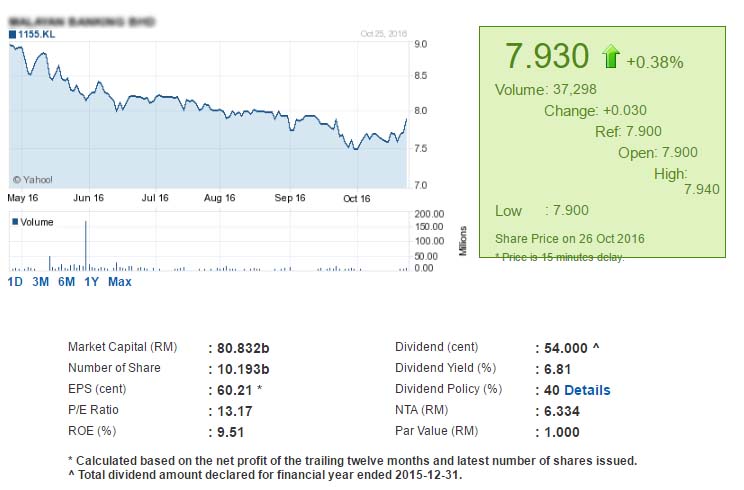

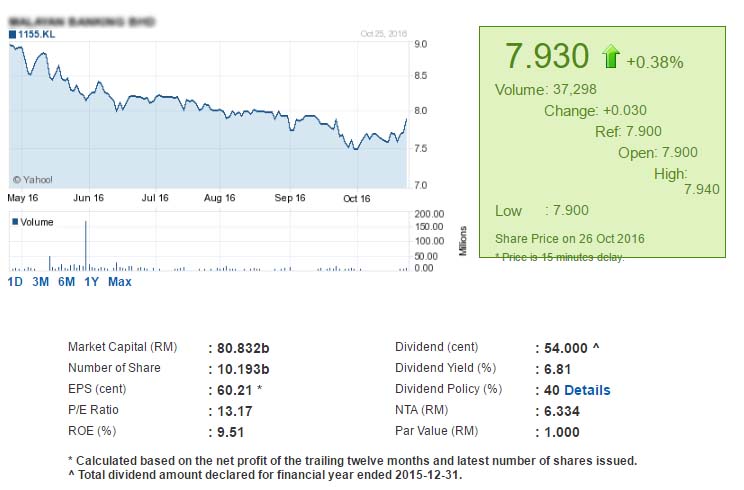

However, blue chip lots are usually more expensive. For example, the price of one share from the example below cost RM7.930.

No comments:

Post a Comment