GoldSilver.com

FEBRUARY 21, 2012

FEBRUARY 21, 2012

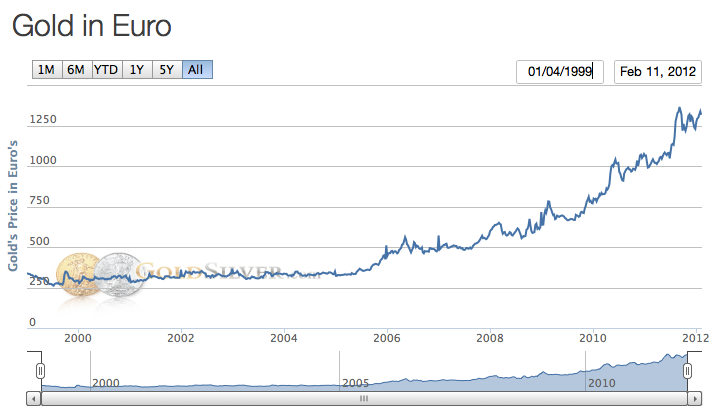

In recent weeks financial headlines have emphasized a strengthening dollar and have seemingly taken an optimistic view on the future direction of the greenback. Yet reality could not be more distant, as the intricate policies of fiat central banking disguise a significant concept within investing: the distinction between price and value. Price is measurement through fiat currency, while value measures assets against each other, more accurately perceiving changes in purchasing power and essentially eliminating inflation. Inflation is the ultimate distorter of price, making it a practical tool for governments and central banks but irrelevant and short-sighted for those seeking wealth appreciation.

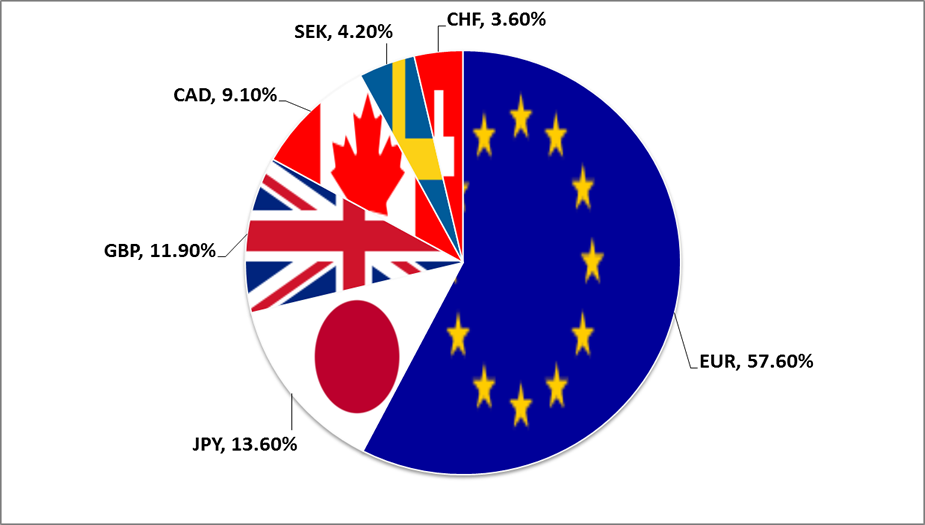

The most widely recognized measurement of the dollar has traditionally been the US Dollar Index which tracks the dollar’s performance against a basket of six global currencies. These include the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona, and the Swiss Franc. Of these currencies the Euro and the Yen have a disproportionate weighting, the Euro alone representing over half of the index. This may provide a clue as to why the dollar appears to be gaining strength, being that the reference point is the developed world’s most troubled currency. Further, the Central Bank of Japan has been and continues to be one of the most intrusive central banks around, actively intervening in global currency markets to artificially suppress an appreciating yen. Just last week, the bank injected 10 Trillion Yen ($130 billion USD) into global markets, taming political pressures from exporters who desire to more competitively place Japanese goods overseas through a cheaper yen. Thus, simply by understanding the fallacy with which dollar price is calculated, it can provide greater insight into how to derive the most significant measure: value.

Currencies are volatile, inconsistent, and in the short term their movements may even appear chaotic. Appreciations may deceive the public as these fluctuations are merely reflective of their pricing relative to one another, yet their value is collectively in decline. The short term is obsolete as these prices are not determined by the free market but rather a handful of central banks and politicians who continuously re-price their currencies throughout manipulative monetary and fiscal measures. In the long term however, fiat currencies are structurally designed to lose value and eventually fail, allowing election- minded politicians to simulate growth through price. Economic reports such as GDP, CPI, and unemployment, traditionally perceived as indicators quantifying growth are often the most distorted by this currency re-pricing. A cheaper currency is the ideal recipe for achieving political objectives, inflating real growth and lowering unemployment through lower real wages.

The generational downtrend of fiat currencies is inevitable and inconspicuously transfers paper wealth away from the middle class at an astounding and unceasing rate. As a nation increases its debt to support its fiat currency, it creates inflation as an expanding currency supply chases a limited amount of goods and services. Central banks may accelerate or decelerate this in the short term through monetary policy or aggressive intervention as has recently been witnessed in Europe and Japan. Ultimately however, fiat currencies remain trapped in a descending channel leading to their obliteration and merely fluctuate amongst each other within this generational downtrend as governments futilely attempt to prolong an absolute collapse.

No comments:

Post a Comment