Another year draws to a close and it seems like everyone’s got New Year’s resolutions on their mind.

To recap, 2016 has not been particularly (positively) eventful for Malaysians as many wrestle with the rising living cost and skyrocketing house prices.

On the economic front, the ringgit continues to weaken against the US dollar,

retrenchment is set to worsen with more than 30,000 laid off as of September, and household debt has reached 89.1%, one of the

highest in the region.

Under such circumstances, paying down debt and saving for your future might seem overwhelming. Rest assured, it is not impossible as all you need are tiny, manageable steps.

Below are seven quick and easy tips to help you get your finances in shape for 2017:

Resolve to learn something new

If you are one of those “I have no idea how bonds work” or “What is an ETF?”, then it is time to get educated.

You do not need to be an expert to gain a working knowledge of investment rules. Neither do you have to spend a fortune on study materials. Just choose a couple of things you do not understand and make it a goal to learn them. Most of the time, you can learn them for free on our site!

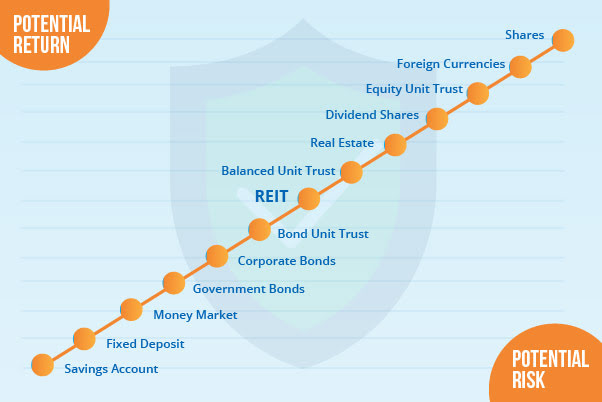

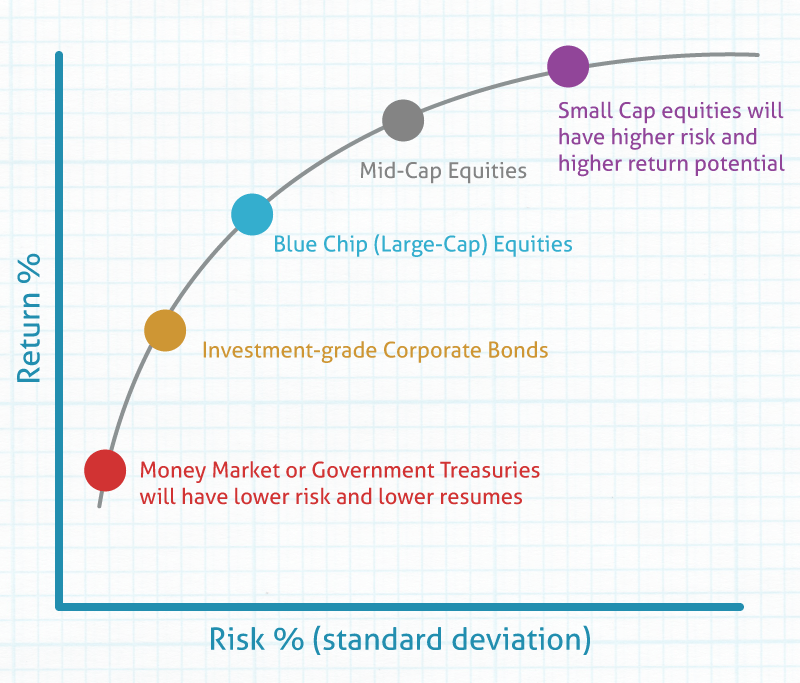

Perhaps try investing in high-risk unit trusts or a real estate investment trust (REIT) or even the different equities on offer. Investing in something different provides an impetus to learn something new while growing your capital.

Pay more than the minimum on your credit card

By now you should know that the term “minimum payment” is not an excuse to take your time to clear off that outstanding credit card bill.

Let’s break it down. Say, you greet 2017 with RM10,000 in debt and you are comfortable with paying the minimum, hoping you could still afford more of what life has to offer. Here’s how much interest you incur after paying off your debt:

Total outstanding balance on your credit card: RM10,000

Interest rate: 15% p.a.

|

|---|

| Paying just the minimum payment of 5% | Paying a fixed amount of RM800 every month |

| First payment: | RM500 | RM800 |

| Subsequent payment: | 5% of outstanding balance | RM800 |

| Total interest incurred: | RM3,157.92 | RM943 |

| Time to pay off: | 6 years 11 months | 1 year 2 months |

Besides clearing debt quicker, you save RM2,214.92 in interest just by paying a higher fixed amount every month.

Remember: When it comes to paying your credit card, settling for the bare minimum makes you a slave to interest. It will also very quickly negate any investment returns you may be getting elsewhere.

Get insurance coverage

According to a study, four to five out of 10 Malaysians

do not have life insurance and among those who have one, have insufficient coverage for their loved ones.

Life insurance policies are designed especially for those who have people depending on them financially, such as young children or elderly parents.

It helps ensure that those you care about will be provided for financially, in the event you are no longer around or lose the capacity to provide them.

There are different types of life insurance. For example, an endowment offers savings and protection while a life annuity works for retirement or tax-deferred wealth accumulation. The best one for you depends on your needs.

Medical insurance on the other hand protects you financially in the event that you are diagnosed with an illness or met with an accident. This covers your hospitalisation and treatment cost so you won’t fall into debt with the increasing medical inflation.

But besides acting as a financial “back-up”, insurance also provides tax relief. Tax payers can claim up to RM6,000 every year for life insurance, and RM3,000 a year for medical insurance.

Even those who already have coverage should check their policy regularly to avoid being underinsured. A policy bought 10 years ago with coverage of RM500,000 is not sufficient today due to inflation. Check your

medical insurance coverage today.

Maximise that lifestyle tax

In his Budget 2017 speech, Prime Minister Datuk Seri Najib Razak unveiled the lifestyle tax relief – a combination of tax reliefs for reading materials, computers, and sports equipment – which Malaysians can claim on a yearly basis.

What can you claim?

The new lifestyle tax allows you to claim these items:

- Reading materials

- Newspapers

- Computer

- Sports equipment

- Smartphones and tablets

- Broadband

- Gym membership

The yearly cap for the lifestyle tax relief is RM2,500. Previously you could claim RM1,000 for reading materials; RM3,000 for computer but once every three years; and RM300 for sports equipment.

Despite the low-ceiling, you could still claim for items not previously available or discontinued such as your broadband subscription. Also, technophiles will love this one as it allows them to claim not just for laptop, but also tablets and smartphones. So keep those receipts!

Clear your PTPTN loan

According to the Department of Insolvency, the country is seeing an increasing number of young bankrupts as many of them are “burdened with study loans.”

Well, good news: under the 2017 budget, graduates get a 15% discount on outstanding debt for full settlement; 10% discount for payment of at least 50% of outstanding debts; and 10% discount for repayment through salary deductions or direct debt. These take effect from October 22, 2016 to December 2017.

Say, Grad A is opting to repay his debt in January 2017 and chooses to do that through monthly salary deduction. He received full financing as his parents were BR1M recipients.

| Bachelor of arts and social sciences majoring in communications at a private university/college | RM102,000 |

|---|

| Type of Education Loan | Loan amount | Administrative cost | Repayment period (years) | Repayment | Total interest |

| PTPTN (Conventional) | RM102,000 | 3% p.a. | 10 | RM121,989.78 | RM19,989.78 |

If he decides to pay through salary deductions, he gets a 10% discount for each payment made. For example, if the first month he is required to pay RM368.22, she now pays RM331.40. If he chooses the maximum loan repayment period of ten years, he pays an overall RM109,790.77. In this option, he saves RM12,199.01.Want to speed up payment? Read on…

Get a part-time job

Malaysians will still deal with the rising cost of living as they enter 2017 and one way to mitigate this financial burden is getting a part-time job.

Never short of options, among the easiest side-hustles is ride-sharing. With car ownership in Malaysia at the third highest in the world, according to the 2014 Nielsen Global Survey of Automotive Demand. So, you would probably own a decent car that takes you from one point to another.

Turn that into a money-making machine by just working six trips and four hours a day, you can earn between RM2,248 and RM2,373 through GrabCar or UberX. In a year, you can potentially earn anywhere around RM26,976 to RM28,476.

What can you do with that amount of money? Plenty. But let’s say you are struggling to clear that PTPTN loan,despite the discounts or want to speed up payment. . Here is how a part-time job with Grab or Uber helps:

| PTPTN loan amount: RM70,000 | Administrative cost: 3% p.a. |

|---|

| Without ridesharing | With ridesharing |

| Monthly repayment: | RM427 | RM1,510 |

| Repayment period: | 10 years | 4 years |

| Total interest incurred: | RM13,718.68 | RM4,524.92 |

Not only will you be able to clear your debt within four years with a side income and still have change to spare, you could save RM9,193.76 in interest!

If ride-sharing is not your thing, check out various freelancing gigs or even that barista opening at a local hipster cafe. The point is: hustle.

Establish a no-spend week (or weekend)

Incorporating a spending freeze into your budget is healthy on your finances. Do this by adding a no-spend week – it is a super way to save a little cash.

For example, this is John’s spending in a week excluding petrol and daily parking fees.

| Groceries + dining out | RM500 |

| Starbucks latte | RM36 (RM12 x 3) |

| Shopping | RM200 |

| Movie ticket | RM9 |

| Total | RM745 |

Establish a no-spend week once a month, and John saves RM8,940 in a year. With that amount, he can easily channel that money to unit trusts or even

stocks and leverage on compounding to grow his savings.

Creative tips during a no-spend week

- Use up whatever that is left in your pantry.

- Download a podcast instead of going to the movies.

- Borrow a book from the library.

- Go for a walk or to the park with your loved ones instead of the happy hour.

- Clean your house and sell items online.

- Learn how to travel for cheap or even do a volunteer trip where you get free lodging and food.

And it all begins here and now

Reality is, most of us will usher 2017 with either some burden or debt to finance. While you can’t melt away the money tension with mere wishful thinking, there are and always will be ways to lessen its impact.

Start off by coming up with a plan that transforms your sources of stress into goals that can be achieved, step by step. Commit to them and be disciplined.

Always seek to clear off debt as quickly as possible and make surplus cash work hard for you. These require some sacrifice, but nothing worthwhile in life comes easy.

To do this, don’t wait after recovering from the New Year after party, get started now and keep track of your spending and progress.

Good luck and Happy New Year, y’all.